What is SDLT?

Stamp Duty Land Tax (SDLT) is tax payable by buyers purchasing a property in England and Northern Ireland. The amount payable by buyers will depend on the purchase price of the property and where buyers are living in the UK. SDLT is often transferred through either your conveyancer or your solicitor. The buyer must send an SDLT return to HMRC and pay the tax within 14 days of completion.

What is stamp duty holiday?

Rishi Sunak (Chancellor) announced yesterday that there will be a cut to to stamp duty effective immediately. Chancellor increased the payable threshold from £125,000 up to £500,000 for properties situated in England and Wales. The Stamp Duty Holiday expires on 31 March 2021.

Therefore, buyers completing on a residential property with a purchase price of £500,000 or below, between the period of 8 July 2020 to 31 March 2021 will not pay any SDLT.

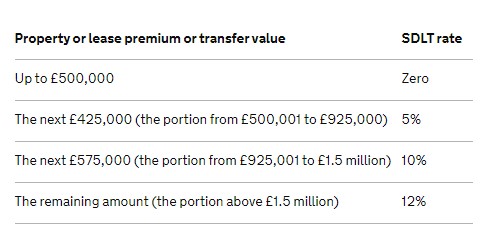

Buyers purchasing properties above £500,000 will be taxed on their value above that amount. Comparison between old rates and new rates as shown below:

Why has SDLT Holiday been implemented & what are the benefits?

Notwithstanding the fact the property market has demonstrated an increase in activity following lockdown restrictions being lifted in May, the property market has suffered during this pandemic. SDLT Holiday is a temporary measure implemented by the government to boost the property market and encourage buyers to proceed to sale.

Buyers benefit greatly as they could save up to £15,000 on a property value of £500,000. Prior to SDLT Holiday, if a buyer purchased a property for £470,000, for example, the buyer would have to pay £8,500 as a first time buyer or £14,100 if the buyer has additional properties.

Contact us today if you have any queries.